TOKENIZING PERSONAL REAL WORLD ASSETS

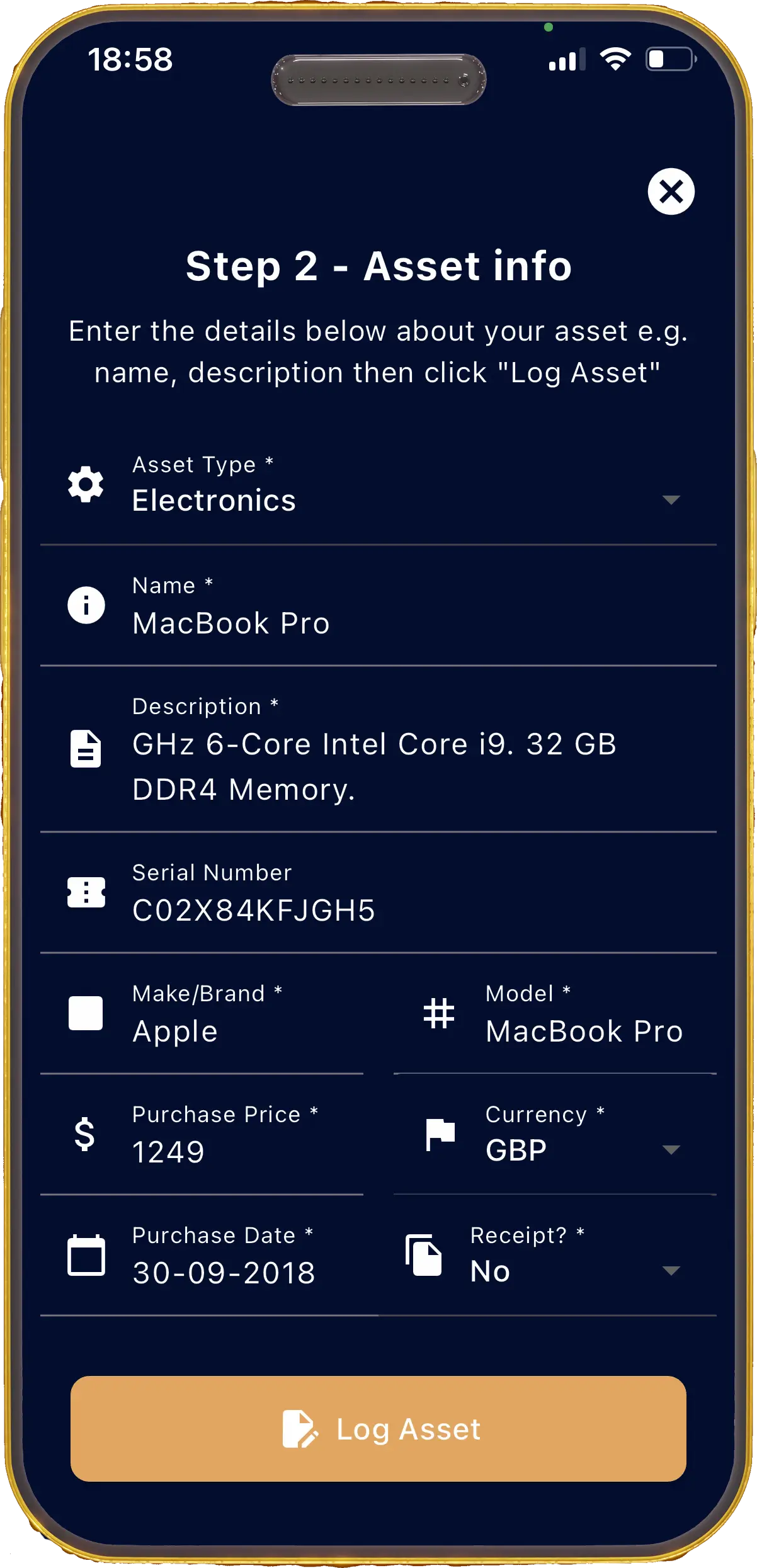

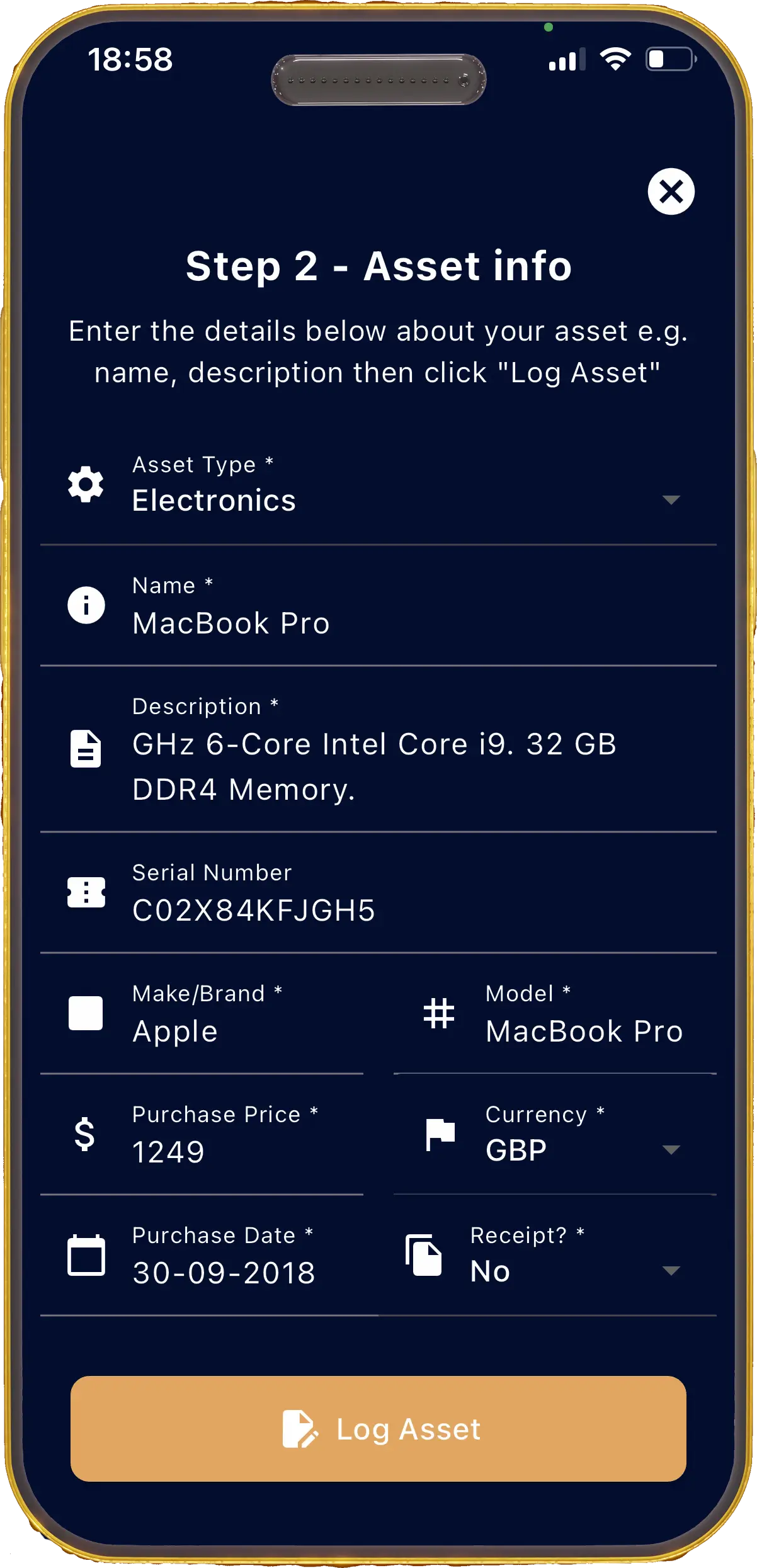

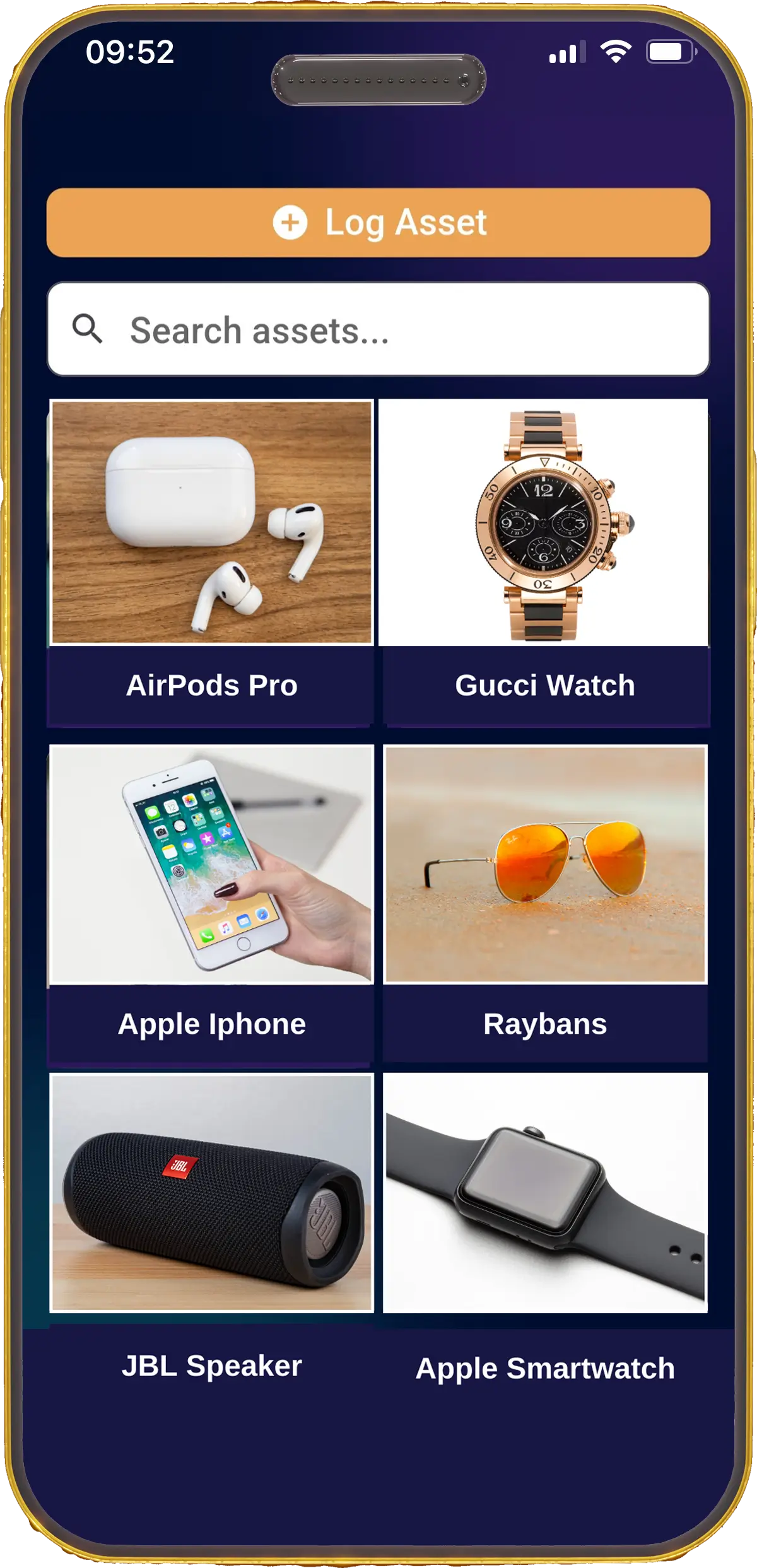

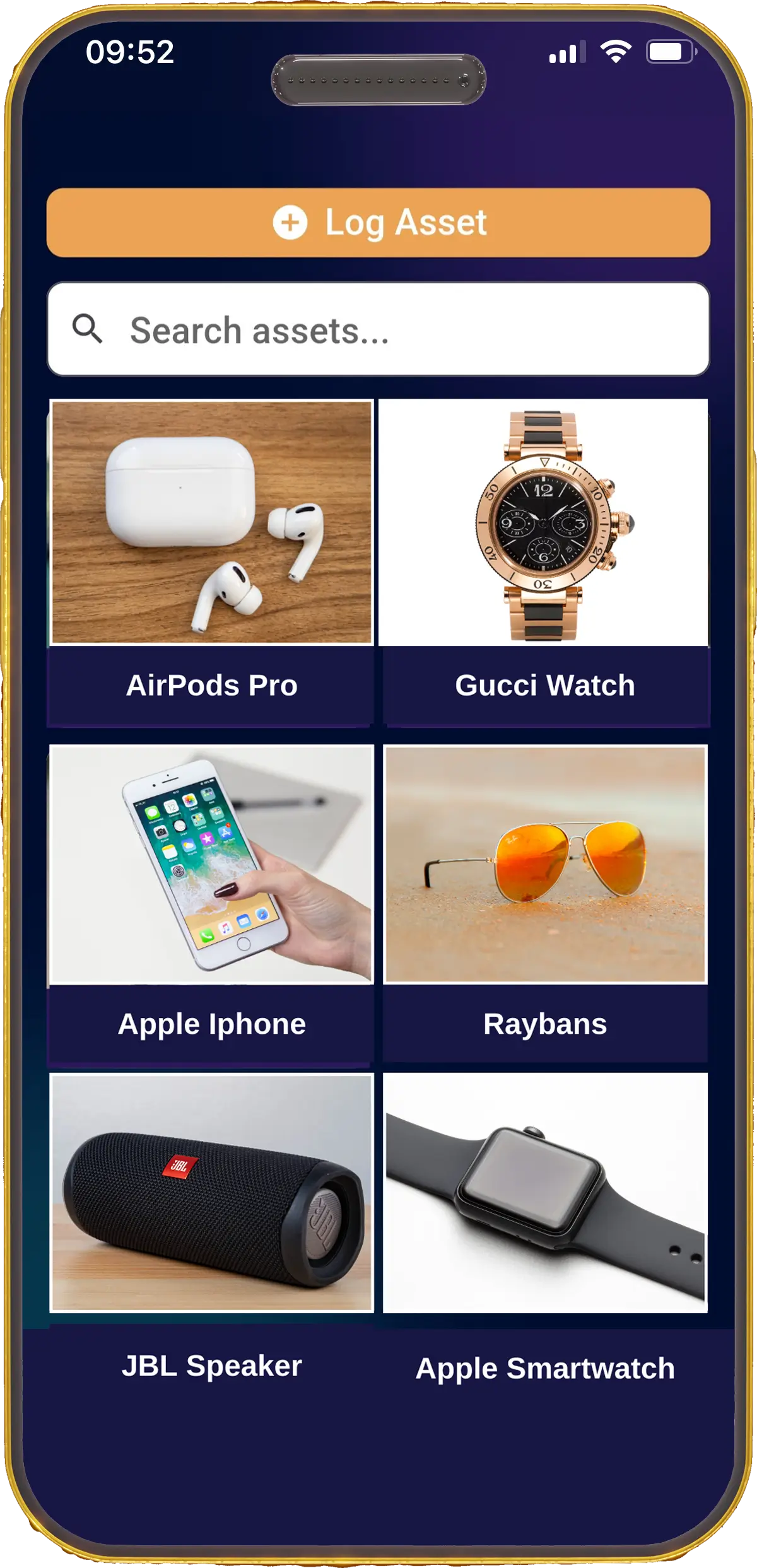

The automatic tokenization of products at point of sale via our eCommerce plugins and the ability for consumers to tokenise their physical real world assets (self certify) via our simple to use mobile app, will help to improve the way we own and manage our personal real world physical and digital assets.

Improve Asset Management

Tokenizing real-world assets streamlines asset management by digitizing ownership records, facilitating automated transactions, and reducing administrative overhead.

Improve Asset Proof of Ownership and Transparency

Tokenization provides a transparent and immutable record of ownership on the blockchain, ensuring clear proof of ownership and enhancing transparency in asset transactions.

Improve Estate Planning and Inheritance

Tokenization simplifies estate planning by digitizing asset ownership and enabling seamless transfer of ownership to heirs through digital tokens, facilitating smoother inheritance processes.

Improve Proof of Product Authenticity

Tokenizing assets enables the creation of unique digital certificates linked to authentic products, allowing consumers to verify the authenticity of goods and mitigate the risk of counterfeit products entering the market.

Enhanced Liquidity of Personal Physical Assets

Tokenization allows owners to fractionalize their assets, unlocking liquidity by enabling the sale of fractions on digital platforms without relinquishing full ownership.

Enhanced Insurance Cover

The tokenisation of assets can bring a range of improvements to the insurance industry including Transparent Ownership Records, Enhanced Risk Assessment, Automated Claims Processing, Faster Settlements, Improved Fraud Prevention and Improved Customer Experience.

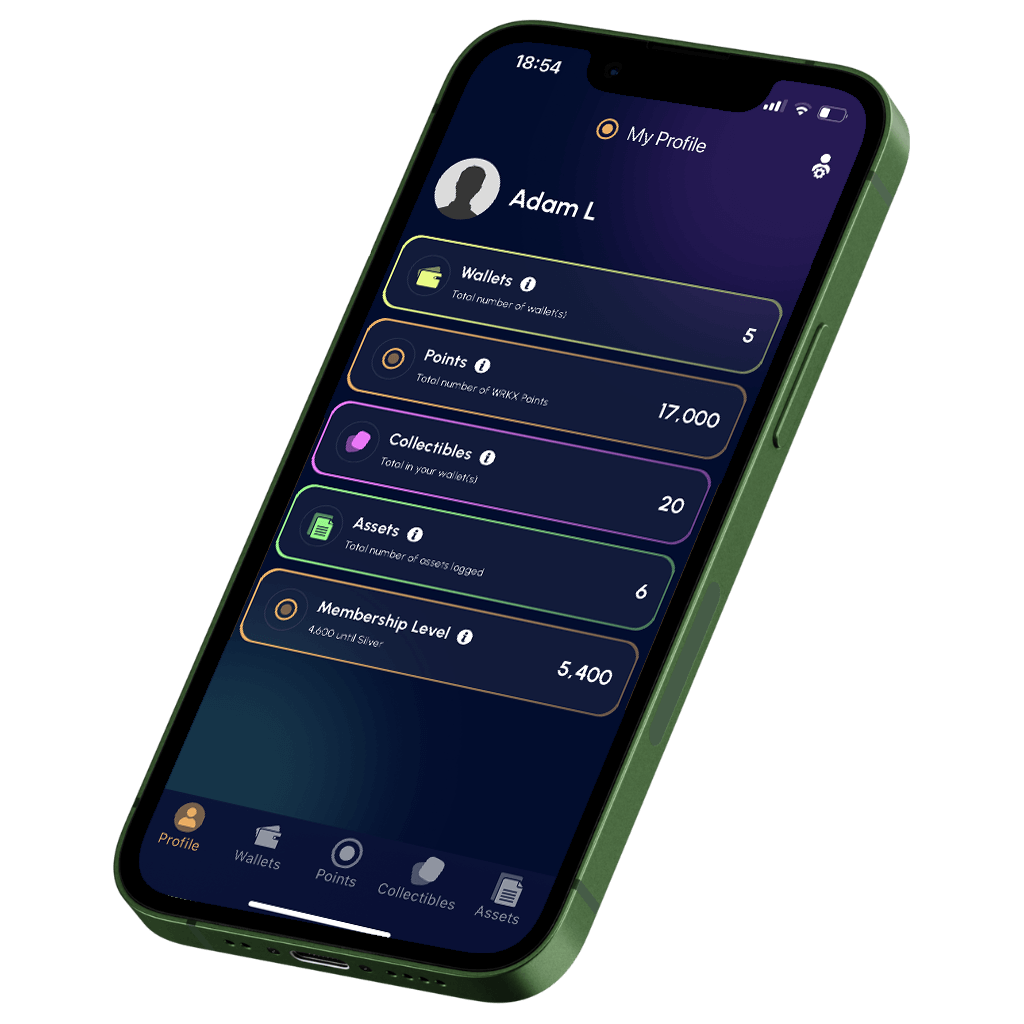

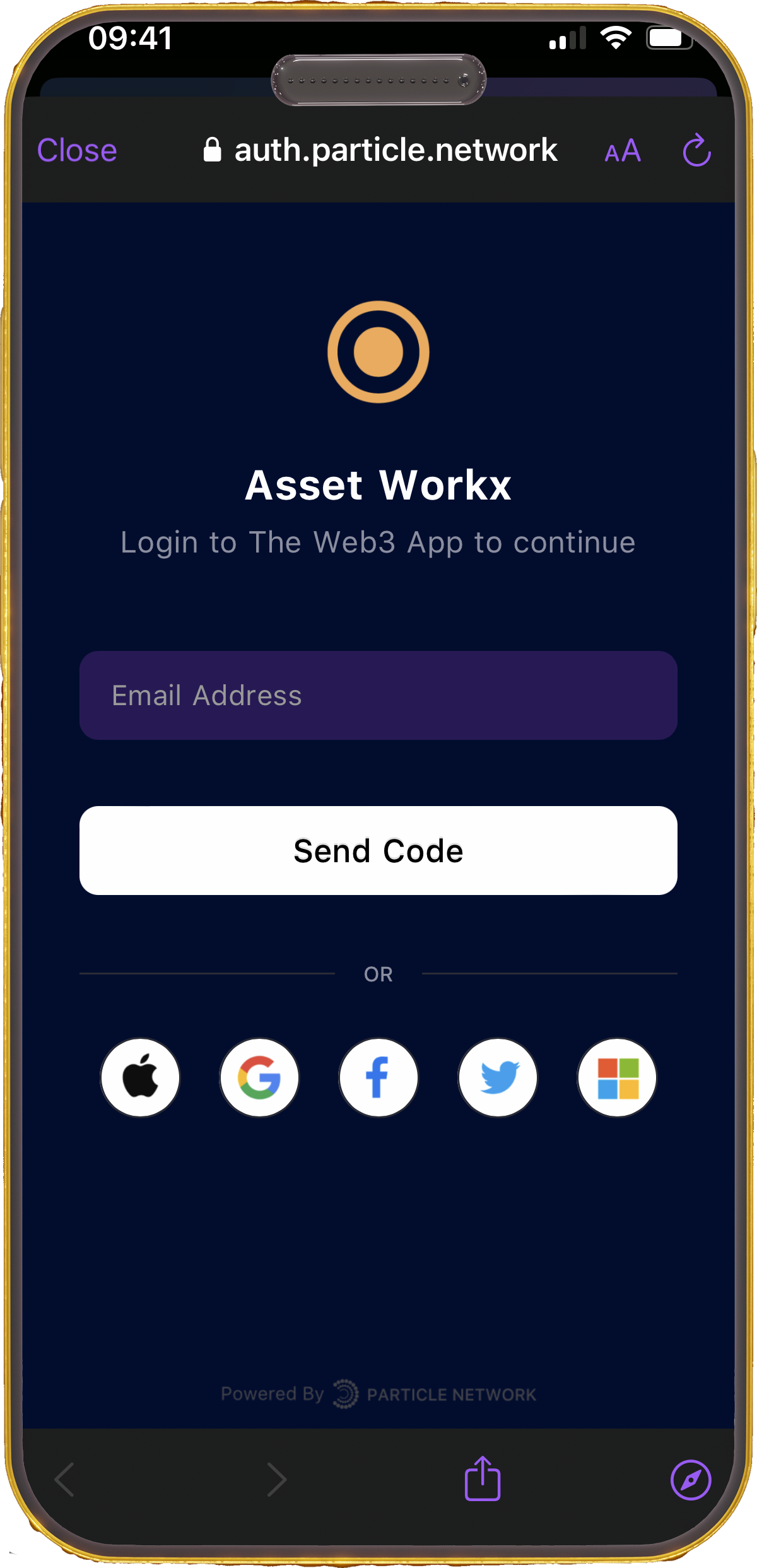

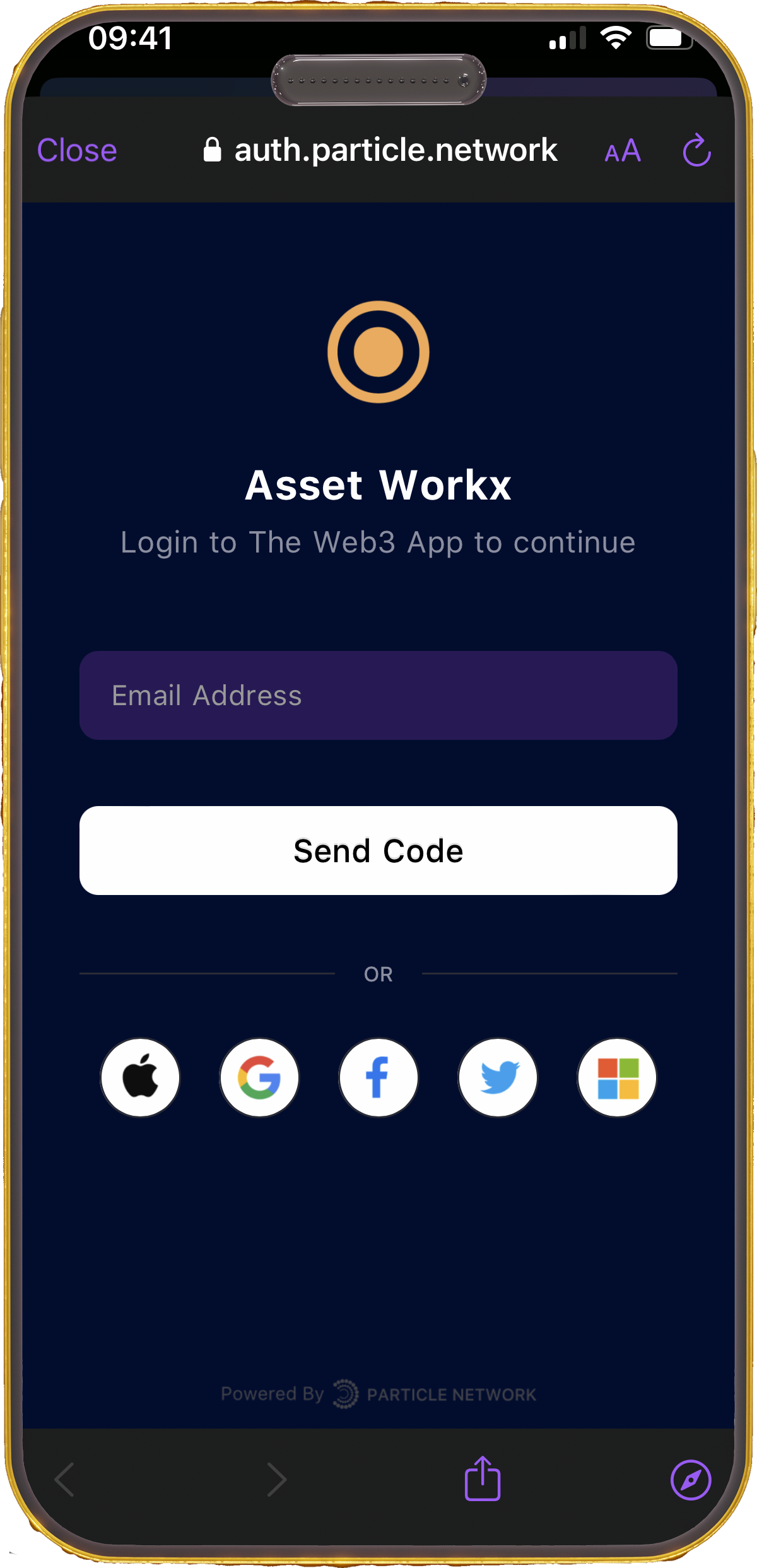

How It Works

Simple Sign Up

Automatic Wallet Generation

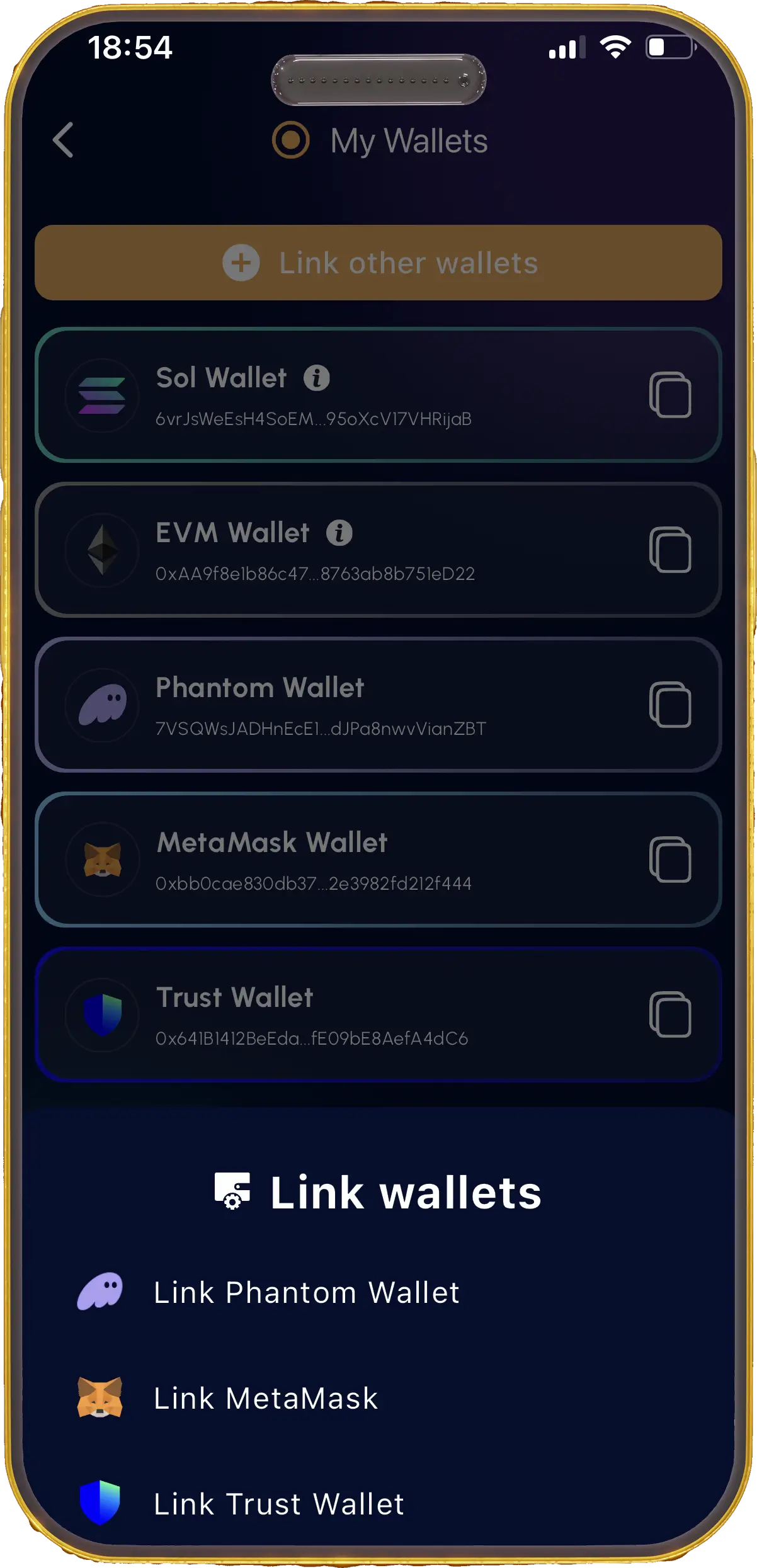

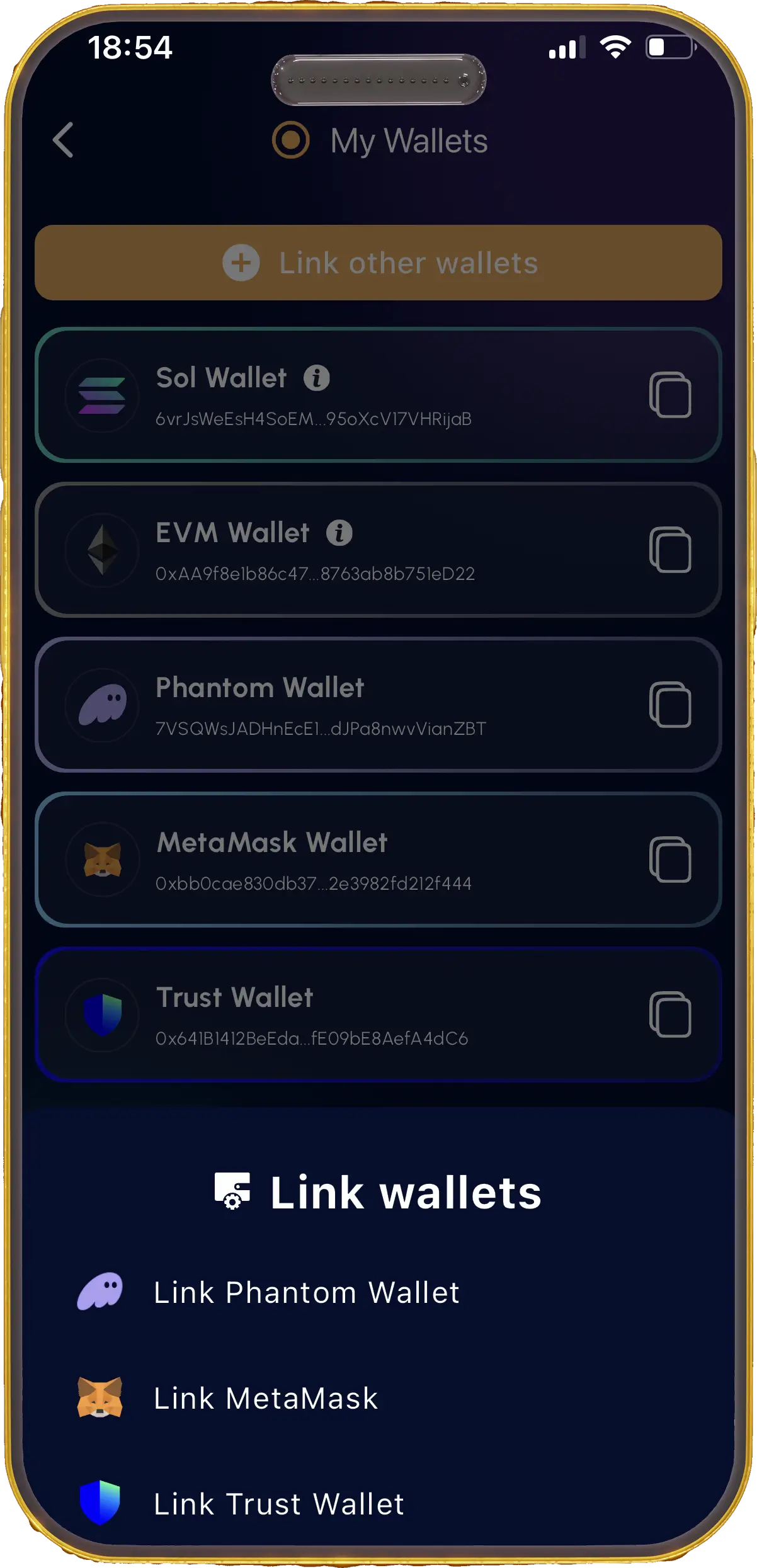

Link Other Wallets

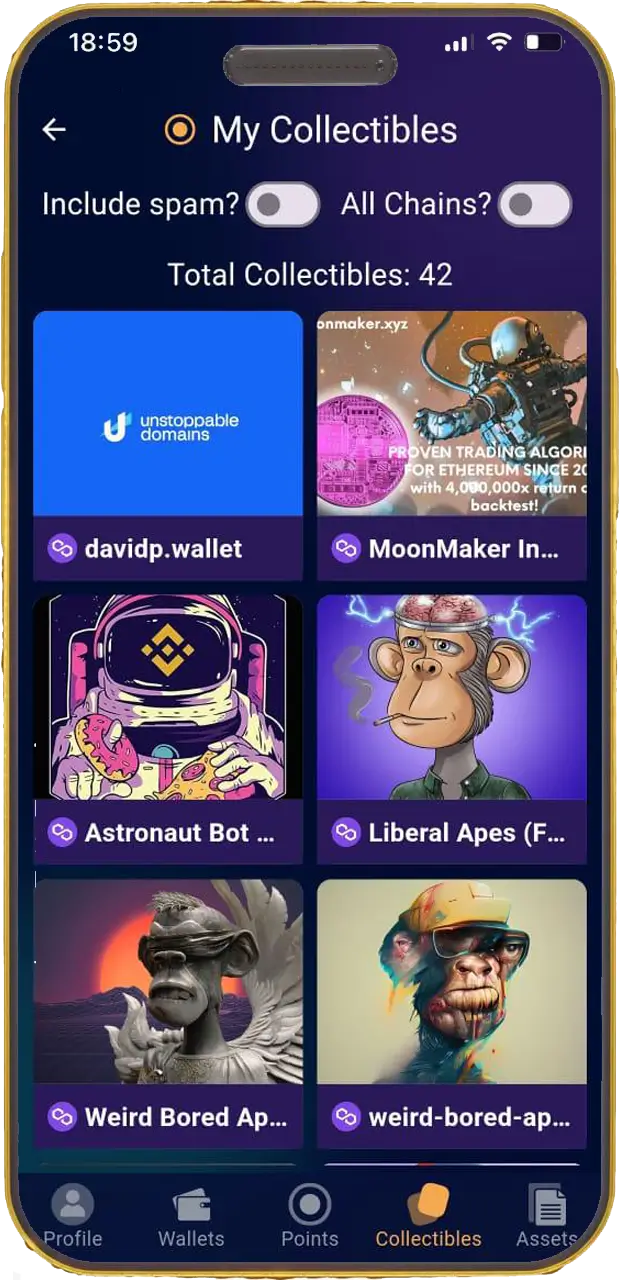

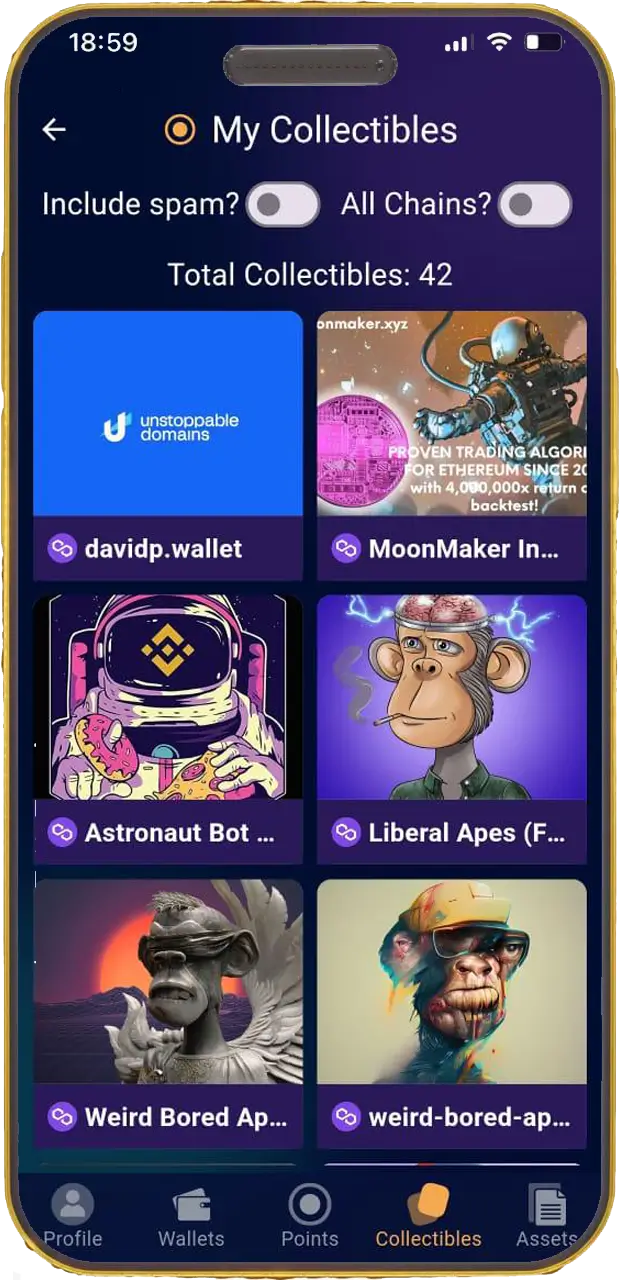

View Digital Collectibles

Tokenise Your Assets

View/Manage Your Assets

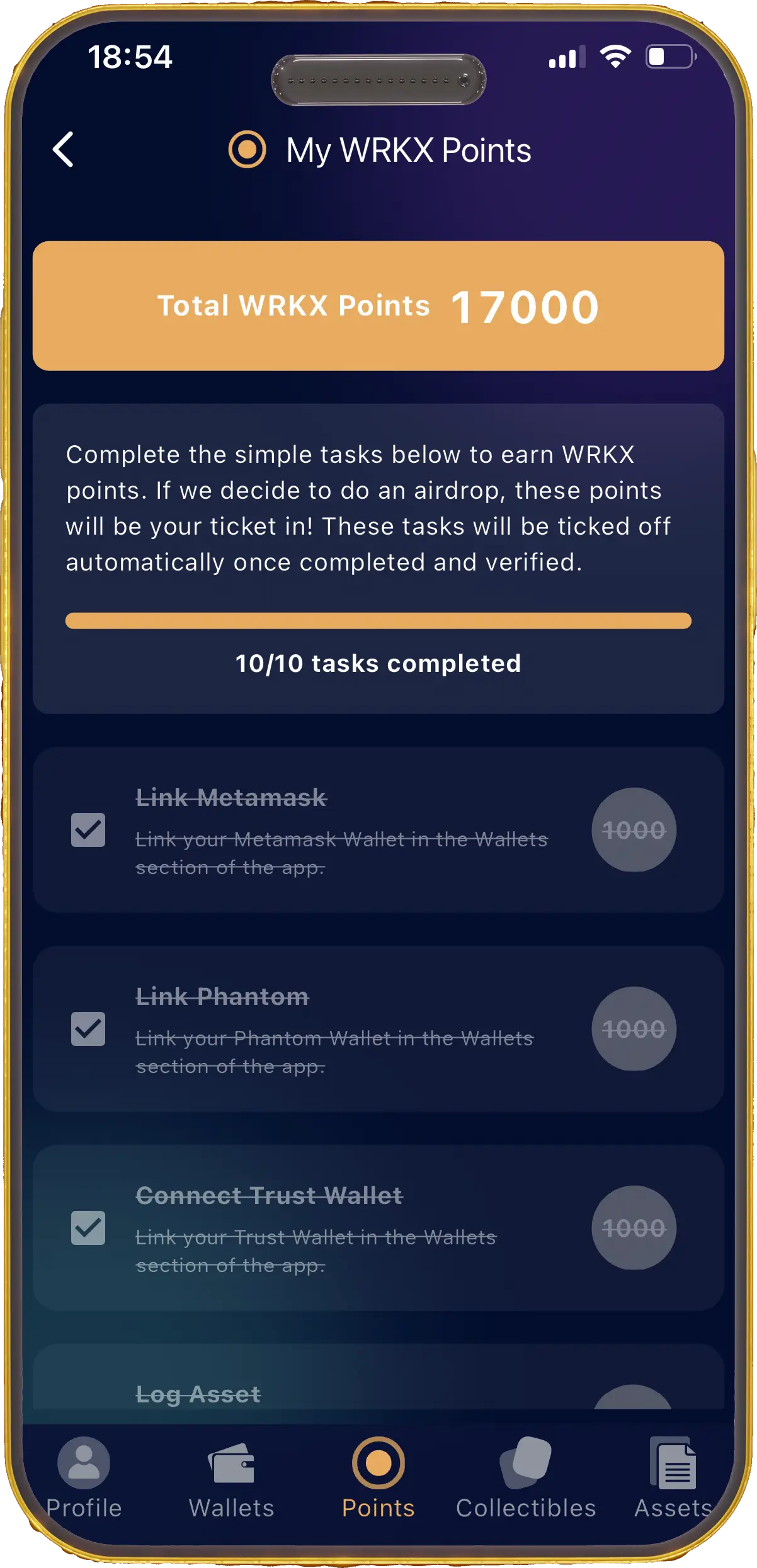

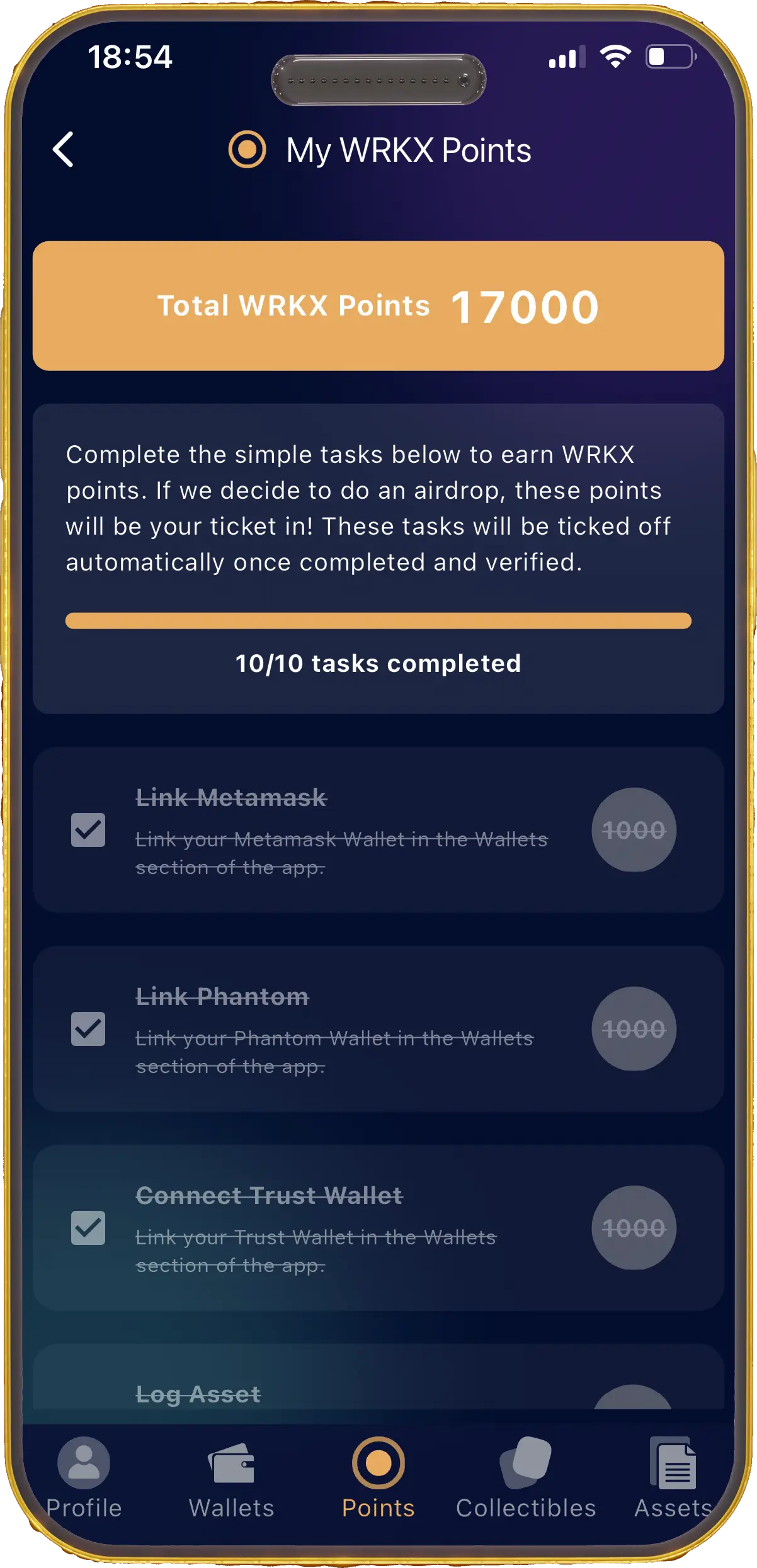

Earn Points

Insure Your Assets (Coming Soon)